I was just chatting with one of my writer friends. It’s awesome to be connected to other writers. She outsourced a little writing job to me which was very cool.

While chatting on text, she mentioned that she took a new job because she needed health insurance.

It’s totally up to an individual if they choose the health insurance package and opt to work for someone else.

But if you love to have your own business or you prefer to freelance on a contract basis, the fear of not having health insurance should not stand in the way of you pursuing your dreams.

When you work for a company who supplies health insurance for you, the monthly coverage is automatically deducted from your pay. You don’t really have to think about it.

When you work for yourself and want health insurance, it takes a little more work and planning. You have more choices, and the responsibility to procure the health insurance is up to you.

Legally, I believe every child must have health insurance at least in the state of New Jersey which is where I live. So even if you are very low income, you can contact your local Medicaid affiliated company to apply for health insurance for your child or children, or as a family.

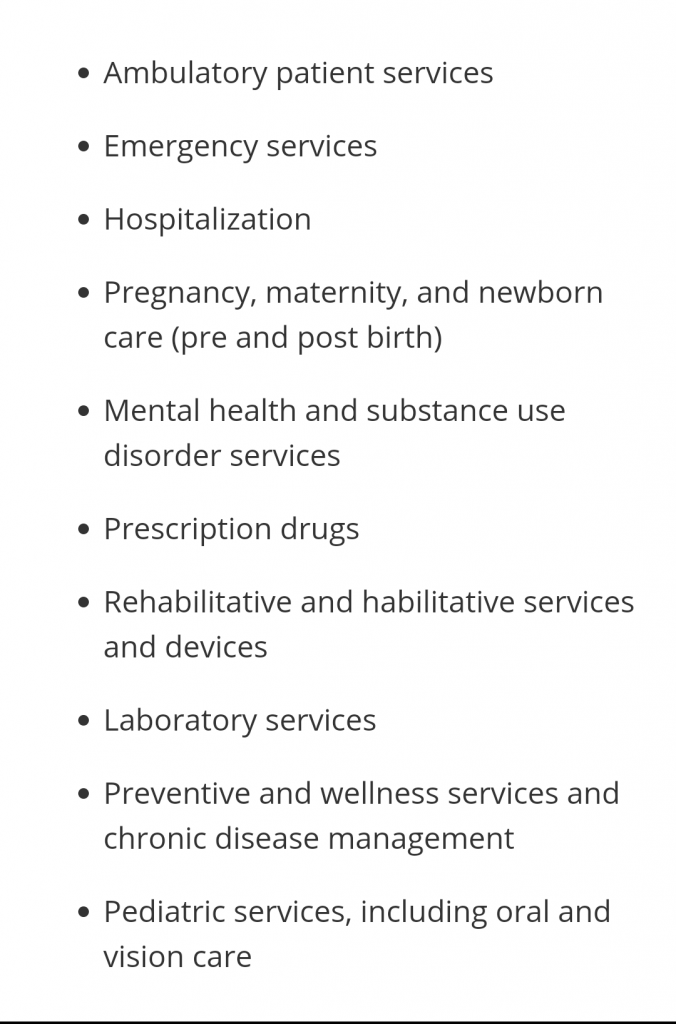

There are 10 benefits that your health care coverage affords you. You can find them on the healthcare.gov website but here’s a screenshot:

To apply for an individual or family health insurance plan through the marketplace, visit Healthcare.gov.

There will be times when open enrollment is on, and then other times when they give you deadlines and tell you that you’re going to have to wait for the next open enrollment period.

It appears that certain emergency life situations such as a move, illness, or a child being born, qualify you as being able to procure health insurance from the healthcare marketplace at ANY time, even when open enrollment is NOT active.

You will also get to apply based on your family income.

Helpful Tips for Those Not Used to Applying for their own Health Insurance:

Avoid applying through the postal mail if you can. Instead, upload your documents, meaning proof of ID and proof of income, to their online site. Doing so means you’ll have a much better chance of getting your application through without delay.

The mail they send you is often boilerplate material. Another helpful tip: you’re going to start to get a lot of physical mail. A lot of it is just templated. Sometimes you will get a request for information that you have already provided. This is another fact of how the world operates now that you’re just going to have to get used to.

If you’re worried that your healthcare application wasn’t received, you can always make a call or log on again and check your status.

Here are some things you’ll need when applying for health insurance:

- Proof of identity such as a driver’s license and social security card.

- Proof of income such as W2 forms from various employers, and/or your federal tax return which shows your gross income on the 1040 plus schedule C profit and loss worksheet if you have a small business that accrues expenses

- Social security numbers of your children

Once it is determined how much you’ll pay for health insurance, you get to pick a monthly plan. One of the most popular and widely accepted health insurance companies is Horizon Blue Cross Blue Shield.

After healthcare.gov approves your application, you can speed things along by contacting Horizon Blue Cross or your other chosen company, directly. The person on the phone should be able to cross reference your application number from healthcare.gov.

The silver plan is usually a mid-range plan designed for families who have children who will be visiting the doctor on a regular basis.

The bronze plans are for people who want to pay a lower monthly and then if they end up going to the doctor they are willing to shell out a bit more in the way of a deductible.

The gold plans (or at least as I remember it) are for people in a higher-risk category who are under a doctor’s frequent care, such as people with chronic health problems.

The amount that you pay per month depends on your reported income. It’s on a sliding scale which is helpful for everyone especially at this time.

Again, you can get your own health insurance and you do not need a full-time job with benefits to do so.

So anyone who is telling you that you should not have a business because you’re missing out on benefits just doesn’t have the same perspective as some other people who are used to this way of living.

This blog post is being published on May 29th, 2021. It just so happens that healthcare.gov has open enrollment from now through August according to the front page of their website.

If you’re worried about paying too-high premiums for health insurance, or if you’ve been freelancing or working on your own business and don’t have health insurance but want it, you can get it.

Head on over to the healthcare.gov website and apply.